The following is a collection of wisdom adapted from a

website page on the Wisconsin Restaurant Association. We encourage you to read their full article linked below.

Restaurant FAQs on Surcharges, Convenience Fees and Cash Discounts

Discover the essential guidelines on implementing surcharges, convenience fees, and cash discounts in your restaurant with this informative FAQ article by the Wisconsin Restaurant Association. Whether you're considering adding these fees or refining your current practices, this article provides practical advice to ensure compliance and customer satisfaction. A valuable resource for any restaurant owner or manager aiming to navigate the complexities of additional charges while maintaining transparency and fairness. Worth a read for insightful tips and strategies.

Here is our brief synopsis from the article:

Understanding Payment Surcharges and Discounts:

What Businesses Need to Know

When it comes to payment options, businesses often face additional costs, especially when dealing with credit card transactions. To manage these costs, some businesses opt to include surcharges or offer cash discounts. Here’s a brief overview of what each entails and the rules businesses must follow.

Surcharges

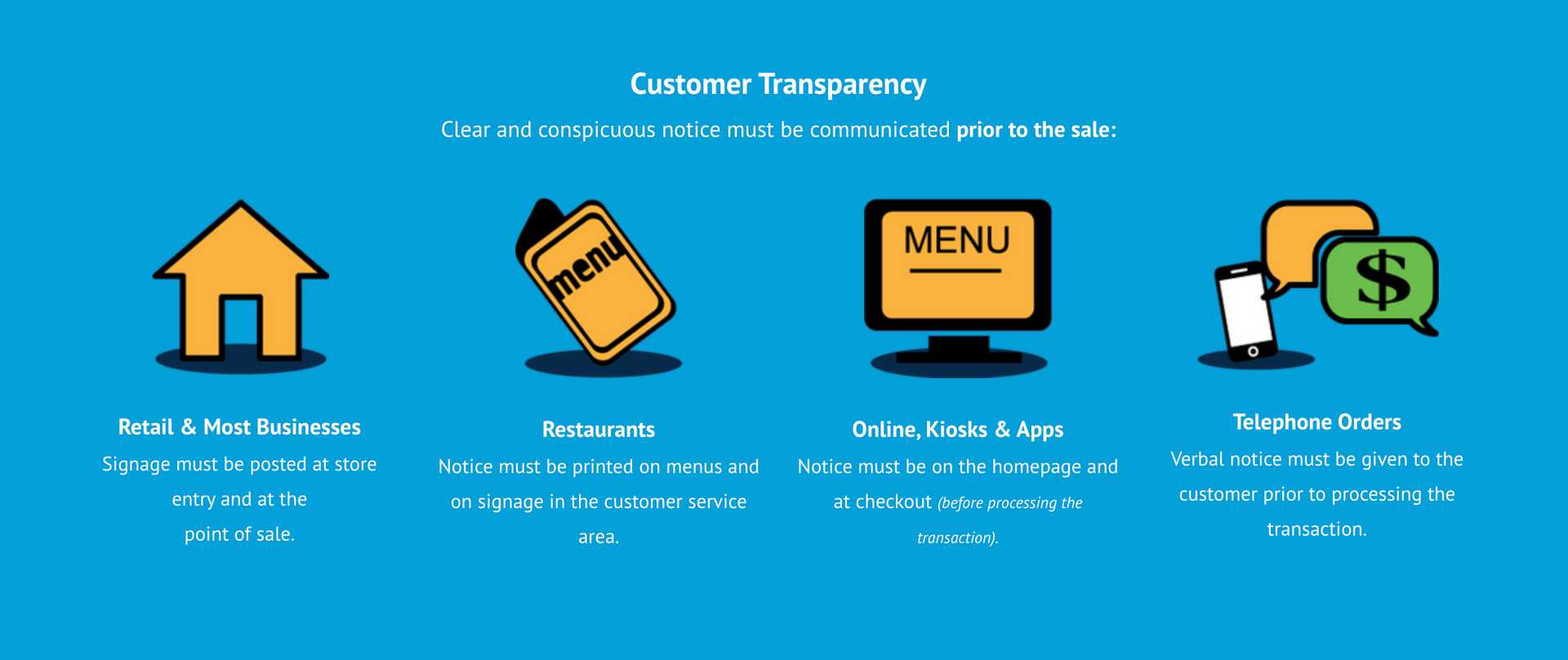

A surcharge is an extra fee added to the published price when a customer pays with a credit card. This fee is intended to offset the costs that businesses incur from credit card processors and networks. However, it's crucial for businesses to note that surcharges:

- Cannot be applied to debit card transactions, even if processed like a credit card transaction.

- Must be clearly communicated to customers before the sale through visible signage in-store and specific notifications in online settings.

- Are capped at a maximum of 3% or at the actual cost of the credit card transaction processing, whichever is lower.

Cash Discounts

In contrast to surcharges, cash discounts are reductions on the published price for customers who pay in cash. This strategy encourages cash transactions which don’t incur processing fees. The key points about cash discounts include:

- The published prices should reflect the amount payable by credit or debit card.

- Like surcharges, transparency is crucial. The discount must be clearly deducted from the advertised price.

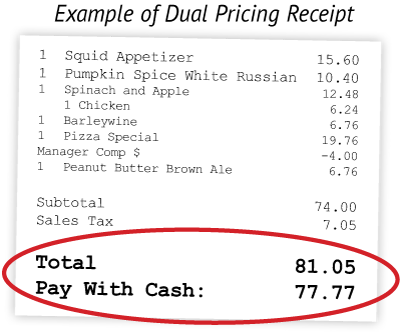

Dual Pricing

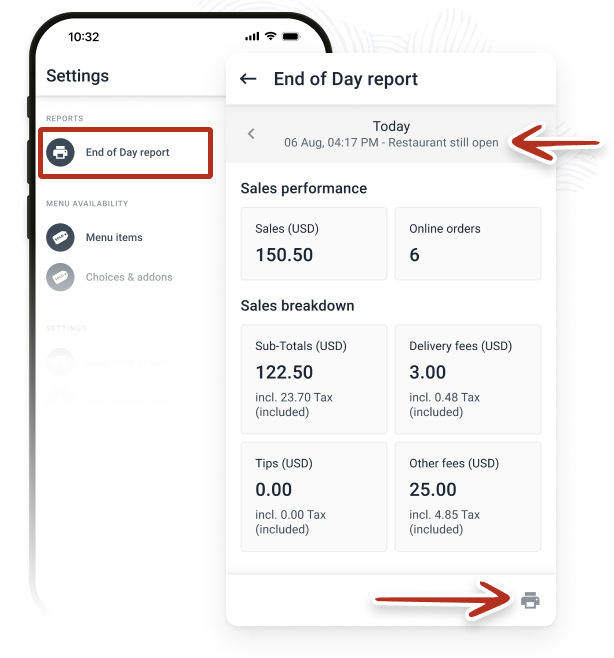

An alternative approach is dual pricing, where businesses display prices that include the credit card transaction fee. This method doesn't add a surcharge at the point of sale but rather integrates it into the displayed price. It requires clear communication and possibly a more sophisticated POS system.

Convenience Fees

These are charged for the convenience of ordering via certain methods such as online or through kiosks, not for the payment method used. These fees must also be clearly disclosed before transaction completion.

Compliance and Transparency

Regardless of the approach, compliance with rules set by credit card brands and consumer protection laws is non-negotiable. Failure to adhere to these rules can result in fines, legal action, and possible termination of merchant accounts.

---

For businesses considering implementing any of these pricing strategies, it's essential to stay informed about the regulations and ensure all practices are transparent and fair to consumers. Always consult with a payments professional or legal advisor to make sure your business remains compliant while navigating these options.